UAN Activation and Registration Process in 2023

Universal Account Number or UAN

Universal Account Number (UAN) is significant for EPF account holders as the whole process connected with the Employee Provident Fund (EPF) administrations is currently worked on the web. Getting to your PF account administrations like withdrawals, checking EPF balances without the assistance of a business, and PF credit applications is simple because of the EPFO gateway. This article covers all that about your UAN Activation Process.

The Universal Account Number or UAN is a 12-digit unique number assigned to each representative adding to the EPF. It is produced and designated by the Employees’ Provident Fund Organization (EPFO) and validated by the Service of Work and Business, Administration of India. The UAN of a worker continues as before all through his life, independent of the number of positions he changes.

Each time a worker switches his/her work, EPFO distributes another member ID number or EPF Record (ID) connected to the UAN. As a representative, one can demand another member ID by presenting the UAN to the new employer. When the member ID is made, it gets connected to the UAN of the worker. Consequently, the UAN will act as an umbrella for the various member IDs dispensed to the representative of various businesses.

The UAN continues as before and compacts over the lifetime of a worker. The worker will have an alternate member ID while exchanging between occupations. All such member IDs are connected to the representative’s UAN to facilitate the course of EPF transfers and withdrawals.

How to Know Your UAN

Once the UAN Activation is done it generates and the EPF account is linked with it, the employer generally provides the UAN and PF details to the employee. However, you can easily find out your UAN in a few simple steps mentioned below:

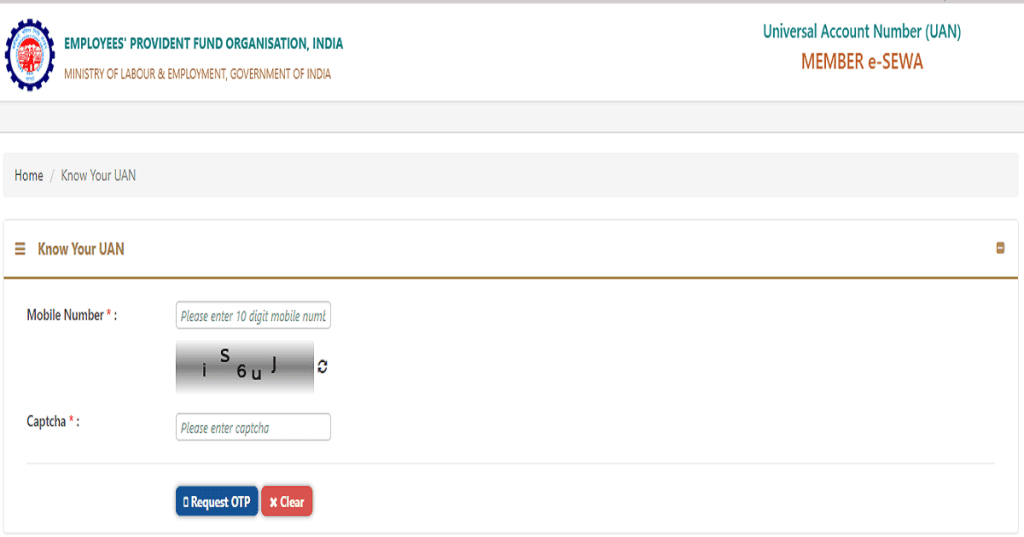

1. Visit EPFO Member Portal to know your UAN.

2. Click on “Know your UAN“.

3. Enter your registered mobile number, and captcha code and click on the button “Request OTP”.

4. Enter the OTP that you receive along with a captcha for verification.

5. Enter your Name, DOB, Aadhaar/PAN/member ID, and the captcha for verification, and click on “Show my UAN” to know your UAN.

[Read more: PAN Card: How to e-PAN Card Download? Step-by-Step Process]

UAN Login – How do I Activate the EPFO Member Portal and login with UAN?

To activate UAN, you must have your Universal Account Number and PF Member ID with you.

Here are the steps to enable UAN in EPFO Portal:

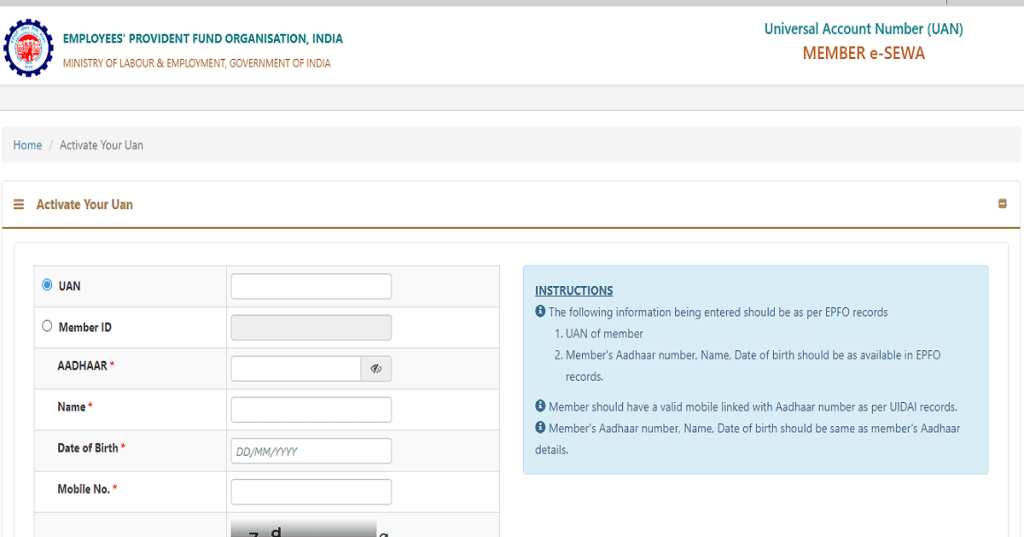

Step 1: Go to UAN Portal and click on “Activate UAN” under the “Key Links” tab in your dashboard.

Step 2: Enter your UAN, Aadhaar Number, Full Name, Date of Birth, Mobile Number, Captcha Code and click on the “Get Authorization Code” button.

Step 3: A new screen will appear on your desktop where you can enter your details. Make sure all information is correct.

Step 4: Now you need to click on the “I agree” check box. Enter a four-digit OTP and click “Verify OTP and activate UAN”.

Step 5: After verification, OTP UAN will be activated.

After activating the UAN, you will receive a password on your registered mobile phone number to access your account.

UAN Activation Via UAN Portal

Before using the EPFO portal to use an EPF-related online service, you must register or activate your UAN. You cannot use any of the online services offered by EPFO without activation. To UAN activation/registration your UAN, do the following:

1. Visit the EPFO Member Portal and click on “Activate UAN”.

2. Enter your UAN/Member ID along with your Aadhaar Number, Full Name, Date of Birth, Mobile Phone Number and Captcha Code and click ‘Get Authorization PIN’.

3. An authorization PIN will be sent to the mobile phone number registered with EPFO.

4. Enter this PIN and click on “Check OTP and activate UAN”

5. Your UAN will be activated and the password will be sent to your mobile number.

6. Now you can log in to your EPF account with your UAN and password.

How to Connect Aadhaar to UAN

After logging in to your EPF account you need to enter your details in UAN. Follow these steps to link your UAN to Aadhaar:

1. log in to your EPF account by visiting the EPFO member’s homepage. Log in to UAN

2. Under Manage, click KYC. Link Aadhaar to UAN

3. Check the box in front of Aadhaar and enter your 12-digit number and surname. Aadhaar.

4. Now click on “Register”.

5. Your application will appear under KYC Pending Approval.

6. Once UIDAI has verified your information, the name of your current employer will appear under Approved Benefit and Approved Benefit. Verified by UIDAI” will be listed next to your Aadhaar.

Documents Required to Open UAN

If you are just starting your career in your first registered business, you will need the following documents to obtain your Universal Account Number.

Bank Account Information: account number, IFSC code and branch name.

ID: Any photo ID and national ID such as driver’s License, Passport, Voter ID, Aadhaar Book and SSLC.

Proof of Address: A recent utility bill in your name, rental agreement, ration card, or any of the IDs listed above, provided it shows your current address.

PAN Card: Your PAN must be linked to the UAN.

Aadhaar Card: Because the Aadhaar Card is tied to a bank account and mobile phone number, it is mandatory.

UAN Card Online Download Process

With a valid EPF number, you can easily download the UAN card by following these steps:

Make sure you have an active UAN with a valid password, to access the EPFO portal.

- Visit the UAN portal.

- Enter your UAN and password along with the displayed Captcha information and click “Login”.

- In the “View” tab, select “UAN Card”.

- The card linked to your account will appear on the page.

- Click Download UAN Card; from the options that appear in the top right corner of the screen.

- You can keep an electronic copy of your UAN or print a paper copy for future reference.

How Can I Reset the UAN Password?

Step 1: Log in to the UAN portal.

Step 2: Select “I forgot my password”.

Step 3: Enter your UAN and Captcha details, then click Submit.

Step 4: Enter your name, gender, and date of birth, and click on the “Confirm” button.

Step 5: Enter your Aadhaar number and Captcha code and click “Confirm”.

Step 6: After confirming the entered data, enter the mobile phone number in the appropriate field and click on “Get one-time password”.

Step 7: The OTP will be sent to the mobile number you provided. Enter a one-time password and click Confirm.

Step 8: You can now change your password. The password must be entered twice in the appropriate fields. After entering your new password information, click Submit.

Once you click submit, your password will be updated on the EPFO portal.

Features and Functionality UAN

1. UAN helps centralize employee data in the country.

2. Reduces the burden on the EPF organization of auditing company employees and employers.

3. This account enabled the EPFO to obtain a member’s bank account and KYC and KYC details without the help of employers.

4. It is useful for the EPFO to keep track of an employee’s many shifts. With the introduction of UNA, late and early withdrawals from the EPF decreased significantly.

5. Many electronic PF services are accessible through the UAN, such as View and download the PF brochure.

6. Get organization details e.g. For example, organization name, joining date, and Employee Retirement Plan (EPS) details. Get a UAN card. Update KYC details. Update master data.

7. Download PF forms such as the complaint form and an EPF account form for a member.

8. Track the status of the EPF request.

Benefits of UAN Activation for Employees

- Each new PF account with a new job is covered by a unified account.

- This number makes it easier to withdraw the PF online (in whole or in part).

- Employees can use this unique account number to transfer their PF balance from the old to the new.

- Whenever you need a PF statement (visa, credit guarantee, etc.) you can download it instantly – by logging in with your Member ID or UAN, or by sending an SMS.

- New employers do not need to verify your profile if UAN is already verified by Aadhaar and KYC.

- UAN ensures that employers cannot access or withhold PF funds from their employees.

- Employees can more easily ensure that their employer makes regular contributions to the PF account.

[Read more: How to Check Aadhaar Bank Linking Status Online & Offline]

Frequently Asked Questions For UAN Activation

The Employees’ Provident Fund Organisation (EPFO) allocates UAN when an employee subscribes to the EPF.

No, an employee can have only one UAN which is transferable across all eligible employers.

Yes, without UAN, you cannot submit online claims.

Yes, the UAN is linked with the PAN.

No

Yes

No